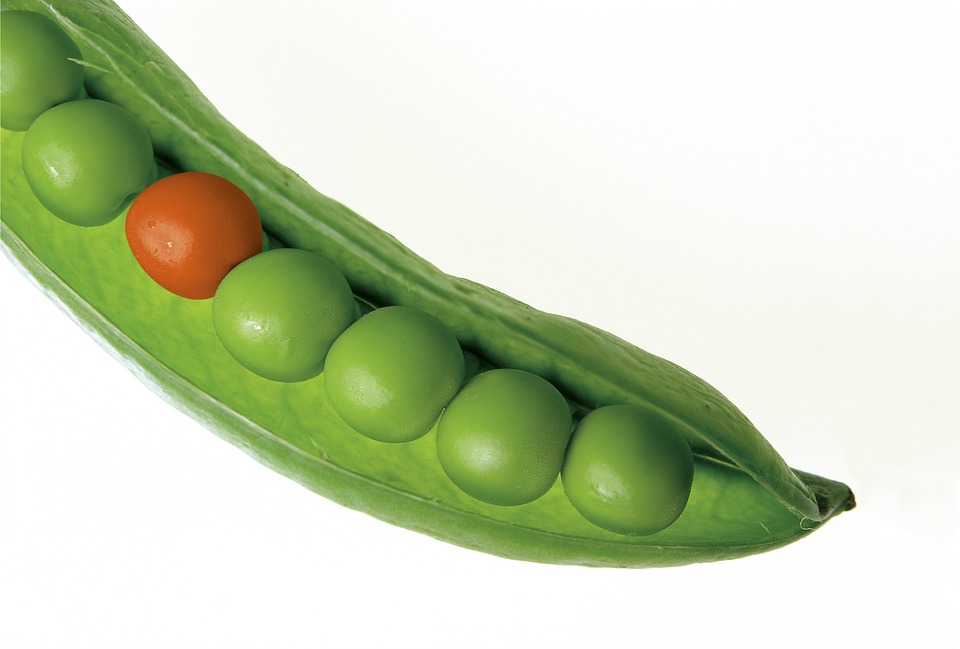

The word “diversification” is often used as part of a stock market strategy – it’s a specific tactic that involves buying multiple different types of stocks to lessen the risk of losing your investment if one of the stocks doesn’t perform well. But the strategy is just as effective for importers and exporters. Here are 3 ways you can use diversification to your advantage:

1 – SPICE UP YOUR INVENTORY

Perhaps the fastest and easiest way to diversify your business is to stick with what you know, but branch out into a few new “flavors.” For example, in India, textile exporters have historically sold knitwear and woolens, but with increasing pressure from competitors and less demand from the US and Europe, they found themselves with fewer and fewer textile sales. So the government launched an effort to encourage Indian textile manufacturers to expand their production into trousers, kids wear, pullovers and jackets. If that type of change sounds daunting to you, don’t be discouraged. Diversification can be achieved in even simpler ways, like adding a new color or size.

If you’re an exporter, talk to your buyers to see if they have any requests before you commit to production on a specific variety. After all, the goal here is to minimize risk… not to take on another production line that flops.

If you’re an importer, consider adding on a few extra varieties of the product you usually order. If no other options are available from the manufacturer’s catalogue, ask if they’ll modify their products and do a custom order for you. While it may inconvenience them in the short run, it could lead to more business for both of you in the long run. If they are not able to diversify their product offerings for you, move on to steps 2 and 3.

2 – TRY SOMETHING NEW

For many people, trying something new can be scary. Importing or Exporting an entirely different, unrelated product can feel like a risk, and it is! But the point here is that taking calculated small risks (like diversifying your product offerings) could potentially save you from one big catastrophic risk down the road. Case in point is the country of Costa Rica, which used to depend heavily on exports of coffee and bananas. Because just two products made up 90% of the country’s export sales, it was particularly vulnerable to the effects of any type of natural disaster, drought, infestation or market fluctuation. Thankfully, the government worked to mitigate risk by pushing for increased diversification. Now, the country’s export market is comprised of a much more balanced blend of offerings ranging from medical equipment, pineapples and fruit juices to prepared foods. This has afforded the country some protection from the particularly volatile coffee prices in recent years.

When it comes to putting this tactic to use in your own business, you don’t have to turn 180 degrees and start buying or selling a product that has absolutely nothing to do with your current offering. Instead, focus on products that could be bought by the same end user. For example, if you deal in footwear, think about adding a complementary product like shoe polish. Or how about adding ceramic mugs to your gourmet tea orders? In addition to diversifying your trade portfolio, these types of product pairings act like a bridge to help you expand into new territories in the event of hardship. In the case of the tea example, what if new tea farming regulations or tariffs made it suddenly impossible for you to trade the precious leaves? If you had diversified, you could continue to sell ceramic mugs (hopefully by then you’ve managed to turn this into a somewhat profitable venture), perhaps adding silver teaspoons and other accessories into the mix. Since they relate to the same end user, your chances of being able to trade the new products with your existing contacts are better (if they need a nudge to diversify their own offerings, send them a link to this article).

3 – TRADE AROUND

Another way to diversify your trade efforts is to branch out and work with a variety of different trading partners from different countries. While this may add a bit more logistical hassle, it protects you against lack of inventory or sales due to politically-motivated regulations or tariffs that could suddenly make your usual routine impossible. And it gives you peace of mind that should your existing partner go out of business, your operation can continue without hardship.

If you’re not ready to dive in with both feet on this one just yet, it’s a good idea to at least test the waters and start developing relationships with “back up” partners you can trust in case troubles arise. Thankfully, meeting trade partners has never been easier. Check out our database at go4WorldBusiness to see thousands of businesses in your industry that are looking to connect with professionals just like you.

Nothing in life is without risk. But with a little diversification, you can build yourself a safety net that increases your chances of long-term success.

Sources: